Nowadays, e-commerce is a popular way to start an online business, but it’s not as simple as it sounds. You may need to select the correct channel and combine payment gateways, to mention a few. As an owner of a Store, you should see to it that everything is organized for the smooth running of the store. You can also look at digital payment statistics since every business, from roadside vendors to online brands, must provide digital payment options.

This is why selecting an appropriate payment gateway is important for easy integration and acceptance of payments. A life-and-death matter cannot be gambled with! Your choice of payment gateway will either make or break your online business. Several good payment gateways are available in the US market. For example, you must consider factors such as e-commerce integration compatibility, safety, pricing, and others while selecting the best US payment gateway.

Just like that, it takes work to make a decision!

I can sense it and, therefore, made up a list of the best payment gateways in the USA. A detailed feature-wise comparison of the top 10 payment gateways in the USA is also available as you choose one that suits your business.

What Is a Payment Gateway?

Shopify payment gateway is a form of processing payments that enables customers to pay for their goods and services online. This makes the payment process between shopper and retailer more streamlined, making it easier and quicker for shoppers to make payments. Shopify Payment Gateway does not only provide comfort but also offers safety that guarantees both buyers and sellers.

When you have many transactions, Shopify Payment Gateway can save your time and money by automating your payments process. Similarly, using a payment provider from Shopify allows you access to customer support who can offer advice on various issues that may arise while transacting.

Also Read:- Shopify Payment Gateway Extension Development

You should go for Shopify Payment Gateway if you are just starting up as an online seller or if you are a customer who wants swift ways of paying online.

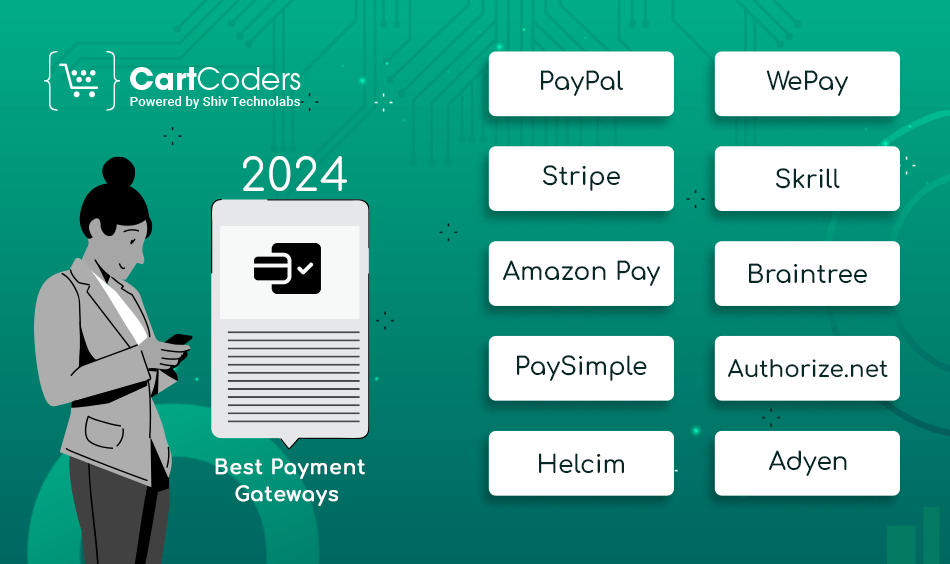

10 Best Payment Gateways For Shopify {2024}

List Of The 10 Top Payment Gateways For Shopify Reviewed

Here are the best 10 payment gateways in the USA, which have a brief explanation for each. Would you like to know in detail? Please continue reading…

1) PayPal

PayPal is among the most famous payment gateways, with more than 400 million users globally. Paypal for business has a unique set of merchant services. Its financial solution provides access to credit cards and loans. It also offers operation products like risk management, shipping tools, and payment products that enable secure money transfers via online channels.

Key Features:

- Checkout experience without interruptions.

- Allows different currencies to be used.

- Protection for buyers and sellers against unsafe transactions.

2) Stripe

Stripe is a supple gateway to Shopify payments where merchants can accept transactions at the point of sale or online. It provides several options for adapting the checkout process, such as integrating with over 300 tools. This means it cannot be accessed separately from the countries where Shopify Payments are available since Stripe powers it. Nevertheless, this move will be perfect for traders living in regions where Shopify Payments is not supported.

Key Features:

- Simple integration for developers.

- Over 135 currencies are supported.

- Advanced fraud protection via Radar

3) Amazon Pay

Amazon Pay, an online wallet-based payment service, was initiated by Amazon in 2007, enabling Amazon users to pay through their wallet balance. This makes it a convenient payment method for millions of Amazon’s customers.

By March 2023, the payment service will be available to businesses in the US and many other countries (such as Japan, France, Germany, and Denmark). As of 2023, the payment system has already had over fifty million registered UPI global users. American BigCommerce, Brooklyn, Chico’s, Forever 21, and Magento use this popular payment gateway.

Amazon Pay provides smooth integration with online stores and is mobile-optimized, especially for mobile shopping. Moreover, it comes with talking Alexa skills that enable users to add products and create wish lists using their voices.

The company offers its solutions to large companies through its online payment solution, which can also be customized via APIs or SDKs.

Key Features:

- Millions of Amazon customers trust it.

- Speeds up the checkout process.

- Mobile integration without seams.

4) PaySimple

PaySimple is among the most flexible payment gateways for small businesses; it allows seamless online payments through web stores, payment forms and embeddable solutions. One of its best features is that it is highly adaptable, and one can move from one system to another without any limitation or charge when a contract ends.

Furthermore, PaySimple supports automated subscription billing which is very important for companies engaged in supplying services via the internet. This function assists in making purchases easier as well as maintaining clients using retention programs leading to regular cash flows.

By these ways PaySimple therefore gives owners various choices of how they would like their money to be paid thus promoting growth and existence in the cyberspace especially where such types of business deals are made among these small-scale firms.

Key Features:

- Billing that recurs and manages subscriptions.

- Payment forms can be customized as per needs.

- Has an analytics and comprehensive reporting system in place.

5) Helcim

Helcim is widely regarded as a fair and affordable provider of payment gateways. They do not require clients to sign contracts or pay monthly fees, and there are no secret charges; hence it is ideal for all types of organizations.

Major credit cards like Visa, MasterCard, American Express and Discover are among the many ways in which Helcim can accept multiple forms of payment. Thus, regardless of whether the business conducts its transactions either online or within physical premises, Helcim’s multifunctional services will enable them to make secure and convenient payments via different channels.

Moreover, their price model is flexible enough to cater for every budgetary need of different kinds of merchants. This also earned them the title “Best Overall Merchant Services” by Nerdwallet. However, companies such as Helcim have cemented this reputation as being reliable cost effective payment processing solutions and trusted partners for businesses looking to excel in today’s competitive market place.

Key Features:

- Transparent pricing that does not have hidden fees.

- PCI-DSS compliance for data security matters.

- Tools like advanced fraud detection are available.

6) Skrill

Skrill is a processor of online payments that makes it possible for customers to purchase goods and services without giving their credit card information to the seller. Instead, one can use his/her Skrill account, which is directly connected to their bank account or debit card.

For merchants, this eliminates fraud and carries lower charges than most credit card processors. Consequently, Shopify traders increasingly choose this as one of the payment gateways.

This allows Shopify merchants using Skrill to accept payments securely and efficiently. It also provides buyers with an alternative means by which they can pay without providing their credit card details.

Key Features:

- A global payment solution with a presence in over 40 countries worldwide.

- Cheap international money transfer services.

- Additional features like two-factor authentication make Skrill safer than ever before.

7) WePay

Wepay is a payment gateway for small business owners who need to accept electronic payments easily. In 2017, it was purchased by JPMorgan Chase to fuse its fintech technology with the bank’s might.

When businesses want to do this flexibly and integrate via referral APIs or white-label solutions, they make it possible to redirect their attention to core strategic objectives. WePay has partnered with several big players, such as BigCommerce, FreshBooks, Constant Contact, and Keep.

This online payment gateway has an embedded fraud prevention system that detects internal ones through social data mining and machine learning algorithms. The greatest advantage of WePay is that it comes with a single SDK and modular APIs, which help developers save time, minimize efforts, and decrease operational costs associated with certification.

Key Features:

- Easy and fast customization process.

- Risk management that adapts to changing circumstances related to cases of online fraud.

- Payments made through various means, such as card or bank transfers, can be accepted through WePay.

8) Braintree

Braintree is one of the many products available on the Shopify app store. You can swiftly combine your new shop with Shopify by using this extension. Once you have done that, you will be able to receive payments from PayPal accounts, credit cards, Google Pay and Amazon Pay as well.

Braintree provides a highly secure and trustworthy payment processing solution to enable you to reach your customers wherever they are and give them the uttermost serenity. The system has robust security measures in place. Also, it is very user-friendly for entrepreneurs who are beginners.

Just as Braintree assures complete safety regarding money transactions, it also helps users get closer to their clients around the globe. Its service framework contains robust security features; beyond question, Braintree is a platform where the highest precautions are taken to guarantee smooth and safe use.

Key Features:

- Accepts PayPal, Venmo, and other eWallets.

- A secure storage location for customers’ details is known as a vaulting system, making Braintree more secure than other similar service providers.

- It is the best solution for small and large enterprises because it could easily scale well with your business needs.

9) Authorize.net

Authorize.net is one of the best suppliers of payment gateways and can integrate with Shopify to ensure that Shopify users enjoy easy payment. Businesses can make credit card and electronic check payments through Authorization.net, a payment gateway that allows them to do so.

Authorize.net offers a secure, reliable way of processing payments and possesses some features that make it a desirable choice for every business, regardless of size.

Most importantly, though, Authorize.net is simple to establish and use; hence, you can receive payments immediately after installation. If you are new in business or looking for a stronger payment processing system, consider trying out Authorize.net.

Key Features:

- All major credit cards and eChecks are accepted here.

- Advanced Security Suite for Detecting Fraudulent Activities on Transactions Performed Through this Website.

- Advanced Detection Capabilities Can Also Be Utilized To Counter Rife Subscription Billing Frauds in the Future.

10) Ayden

Ayden is a payment gateway for B2B, subscriptions, and B2C web transactions. Ayden enables merchants to create fully tailored payment experiences with the help of artificial intelligence technology that fights against fraud. It is one of the best e-commerce options for those looking for a strong platform for fee processing utilized by big brands like LinkedIn, Spotify, and Uber.

Key Features:

- Global reach with over 200 methods of payment covered by Ayden.

- One solution across all sales channels from the web to brick-and-mortar stores.

- Use of artificial intelligence in fraud detection for safe payment.

Conclusion

You have seen various payment options that can function well in your Shopify store. Some are suitable for small businesses, while others are for medium and large ones.

It would help if you considered many things when looking for the best payment gateways or methods for your Shopify business. It is always important to sample different modes of payment before making any final decision.

If you need an expert’s opinion, we are willing to share our many years of experience in e-commerce. Seek help from our Shopify experts today.

Moreover, if you face difficulties setting up your Shopify store, feel free to consult this checklist on how to set it up quickly and prepare it for the first sale.

Revolutionize Your Digital Presence with Our Mobile & Web Development Service. Trusted Expertise, Innovation, and Success Guaranteed.