Table of Contents

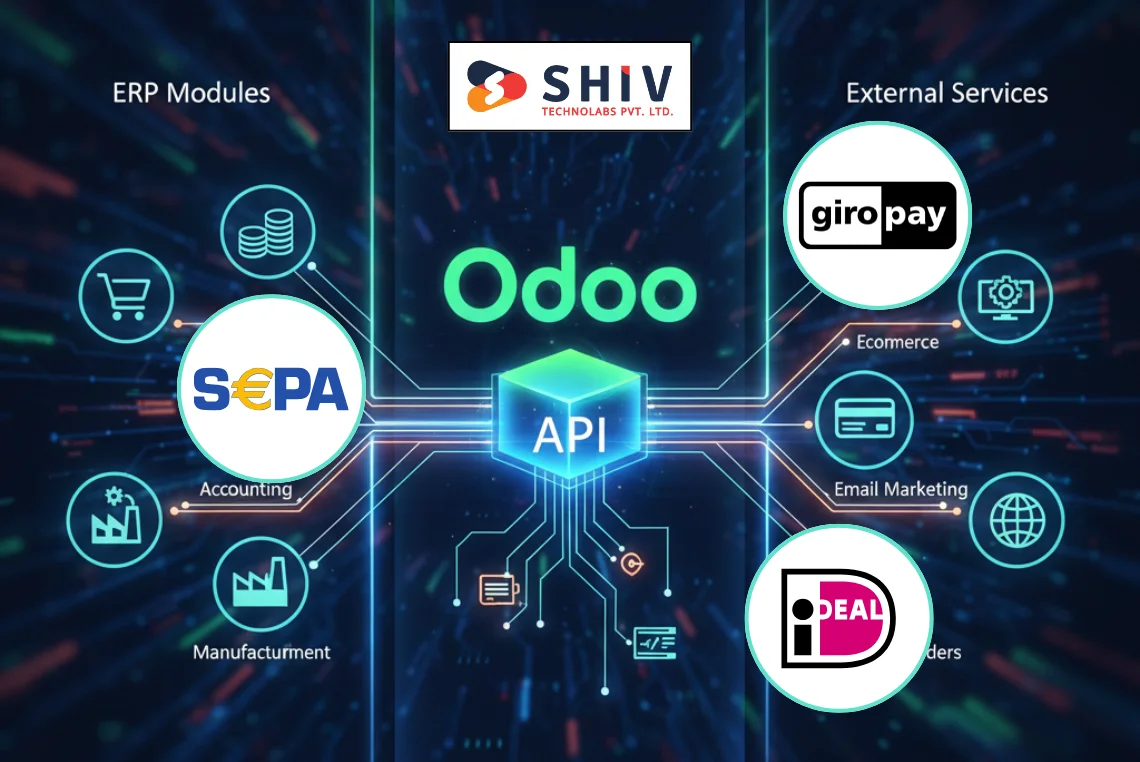

Odoo connects ERP, billing, and Dutch payment rails in one controlled workflow. Our Odoo API Development Services in the Netherlands link your system to SEPA, iDEAL, and Giropay with clear, repeatable steps, so finance teams work faster because payment events post to the right journals at the right time.

Dutch businesses want fast, secure, auditable payments across checkout, invoicing, and payouts, and teams ask for fewer spreadsheets, fewer handoffs, and fewer late fixes after month-end. Odoo supports this goal with modular apps and stable APIs that match real finance work. You keep control while cutting delays between order, capture, and reconciliation. For broader ERP needs, see Odoo Development Services Netherlands.

Reliability sits at the center of our approach, using idempotency keys, signed webhooks, and queued workers for safe retries. Every call writes a trace you can audit, and posting rules remain consistent across journals. Reconciliation and reporting stay predictable during peaks, giving you steady cash visibility throughout the day.

Why Dutch Businesses Should Consider Odoo API Integration

API-based automation is now essential for Dutch SMEs and enterprises that process daily payouts and refunds. Manual entry cannot match sales peaks, subscription runs, and seasonal spikes. Odoo API integration replaces copy-paste steps with event-driven syncing across orders, invoices, settlements, and refunds, which cuts errors and speeds support replies.

Odoo handles large volumes by queuing tasks, logging events, and retrying safe calls when networks are slow. Reference numbers carry from checkout through bank confirmation, so postings land in the correct journals. When rules change, you adjust configurations without rebuilding your stack, and your team gains clearer cash positions during the day for better planning.

Key gains for reliability:

- Fewer entry mistakes through direct gateway callbacks and strict field validation.

- PSD2 and GDPR kept on track via permissions, retention rules, and action logs.

- Faster reconciliation and reporting with consistent metadata across payments and refunds.

- Lower downtime risk with health checks, rate limits, and alerting on webhook failures.

- Cleaner refund routing with idempotent flows and duplicate-safe retries.

Key Payment Gateways in the Netherlands and Their Role

SEPA, iDEAL, and Giropay cover most payment needs for Dutch and EU sellers. SEPA supports account-to-account transfers with predictable fees and timing, fitting B2B and recurring payments well. iDEAL leads domestic ecommerce with strong consumer trust and quick confirmations, while Giropay connects you with German buyers to grow cross-border sales from one Odoo dashboard.

Payment gateways for Dutch businesses – quick view

| Gateway | Primary Use | Benefit for Dutch Businesses |

|---|---|---|

| SEPA | Bank transfers | Ideal for B2B and recurring payments |

| iDEAL | Domestic payments | Trusted for online purchases |

| Giropay | Cross-border EU | Simplifies German-Dutch trade |

These rails dominate Europe for predictable settlement and clear references. We configure issuer webhooks, signature checks, and fallback polling where needed. Refunds post with the right links, and chargebacks map to dispute journals. Your staff sees one consistent flow across gateways, which keeps support answers quick and audit questions simple. We map issuer error codes to actions, so teams respond fast during live traffic. You can also plan broader integrations with Odoo Integration Services.

How to Integrate SEPA, iDEAL, and Giropay With Odoo ERP in the Netherlands

If you want to know how to integrate SEPA, iDEAL, and Giropay with Odoo ERP in the Netherlands, follow a simple, reliable path. We design flows that match your invoicing, refunds, and payout schedules, then ship a staged rollout with clear checkpoints and go-live support.

Key steps:

- Configure gateway credentials and API keys for each provider, using test accounts first.

- Set payment endpoints inside Odoo, register webhooks, and verify signatures for callback security.

- Map orders, invoices, journals, and bank statements, including references and chargeback codes.

- Test sandbox transactions, partial captures, refunds, and payout files, then confirm error handling.

- Enable automated reconciliation, refund routing, and scheduled jobs for daily statements.

Compliance setup:

- PSD2: Apply strong customer authentication flows and keep event logs for audits.

- SEPA: Align pain.001, camt.053, and mandate details; verify IBAN formats and creditor IDs.

- GDPR: Limit roles, mask sensitive fields, and apply retention windows for personal data.

We package this work as Odoo payment automation solutions. Your finance and support teams gain one source of truth for payment status, settlement timing, and refunds. After go-live, we track health metrics, webhook latency, and retry counts, then tune configurations during the first closing cycle.

Benefits of Connecting Payment Gateways to Odoo

You get faster posting, cleaner reconciliation, and stronger cash visibility across channels. Odoo API integration ties checkout, accounting, and banking into one rhythm, so teams answer customer and auditor questions quickly and confidently. If you need custom modules for bank flows, see Odoo Module Development.

Operational benefits:

- Real-time transaction visibility.

- Quick and secure data synchronization.

- Simplified accounting and tax handling.

- Automatic invoice generation and tracking.

- Scalable integration for multiple currencies.

These wins lower support burden and cut closing delays because data arrives with the right references and amounts. Teams adopt changes faster because configurations follow your existing chart and journals. Executives see reliable dashboards with current collections and aging, which support purchasing and staffing decisions without guesswork.

Why this matters now: Dutch buyers favor iDEAL at checkout, suppliers request SEPA for recurring B2B runs, and German customers often pay through Giropay. Bringing these rails into Odoo reduces manual steps, keeps error rates low during peaks, and gives your staff a consistent playbook for refunds, disputes, and reconciliations.

Handoff, training, and support: We run short workshops for finance, support, and tech leads, using your real orders and invoices. Teams practice refunds, partial captures, and dispute handling inside Odoo, then confirm month-end tasks with a checklist. We deliver runbooks, dashboards, and alerting rules, so staff can spot issues early and act without delays.

Performance and monitoring: We set rate limits, backoff rules, and idempotency keys to keep traffic stable during peaks. Dashboards track success ratios, webhook round-trips, and reconciliation match rates by gateway. When banks change formats, we patch mappings and update tests, then publish notes to your team. This practice keeps projects healthy after launch and protects your payment reputation across all environments.

How Much Does Odoo API Integration Cost in the Netherlands?

If you ask how much Odoo API integration costs in the Netherlands, pricing depends on scope and speed. We size work by gateways, reconciliation rules, data quality, and reporting needs. You receive a fixed estimate with milestones, so finance can plan approvals with confidence and clarity.

Start small, then grow. Many Dutch teams begin with SEPA, validate results, and add iDEAL or Giropay later. This staged approach reduces risk, controls spend, and proves value early. We include documentation, runbooks, and post-launch tuning to keep match rates high and support tickets low.

Cost Table – Odoo API Integration (Netherlands)

| Integration Type | Estimated Cost (€) | Ideal For |

|---|---|---|

| Basic setup (single gateway) | 800–1,500 | Small businesses needing SEPA receipts and straightforward reconciliation |

| Multi-gateway setup (2–3 gateways) | 1,500–3,000 | Medium retailers adding iDEAL and SEPA with refunds and payout mapping |

| Advanced automation (workflows + reports) | 3,000–6,000 | Enterprises with complex flows, multi-company journals, and disputes |

Cost factors to consider:

- Complexity of workflows across orders, invoices, payouts, refunds, and disputes.

- Number of gateways and companies, including currencies and tax rules.

- Testing requirements for edge cases, chargebacks, and bank file formats.

- Ongoing maintenance costs for issuer changes, mandates, and reporting.

We work in your Odoo staging, share test scripts, and provide change logs. Your staff can reuse these assets during upgrades or audits, which protects continuity when teams rotate. Procurement teams can choose fixed-price or capped time-and-materials to match internal policy.

Odoo Payment Gateway Integration Timeline

We publish an Odoo payment gateway integration timeline before work begins. Stakeholders get dates, handoffs, and exit criteria for each phase. Most projects in the Netherlands are completed within four to six weeks, shaped by data readiness, team availability, and test depth across scenarios.

We move from scoping to build, then guide your staff through live traffic. During the first settlement cycle, we watch webhook latency, retry counts, and match ratios. If banks change formats or codes, we adjust mappings and tests quickly, then brief your team with short notes.

Timeline Table – Odoo Payment Gateway Integration

| Phase | Duration | Key Task |

|---|---|---|

| Planning & requirement analysis | 1 week | Define payment scope, map fields, select journals, outline risks, confirm reports |

| Build & testing | 2–3 weeks | Configure SEPA, iDEAL, Giropay; register webhooks; run sandbox cases; validate rules |

| Go-live & training | 1 week | Production checks, team training, dashboards, alerts, and first closing review |

Typical completion time: 4–6 weeks. We can add canary traffic, backout steps, and on-call support during go-live. After closing, we review metrics with finance and tech leads, then schedule light tuning to keep results steady as volume grows.

Real-World Examples From Dutch Businesses

Ecommerce retailer (NL): Connected iDEAL for checkout and SEPA for payouts inside Odoo. Refund handling time dropped by ~40%. Month-end closed two days sooner because payouts arrived with clear references and matched journals.

Subscription platform (B2B): Shifted monthly SEPA runs into Odoo with mandates and debtor checks. Failed debits triggered automatic follow-ups and retries. Finance stopped tracking spreadsheets and gained better forecasts across billing cycles.

Manufacturer selling into Germany: Added Giropay alongside iDEAL. Cross-border orders posted with correct partners, VAT, and references. Procurement approved supplier payments faster, while accounting kept disputes in a single journal.

Marketplace operator: Used iDEAL for buyer payments and SEPA for vendor payouts, each with separate journals. Vendors received clean statements. Bank lines matched the same day. Dispute codes mapped to actions, so support acted quickly during peaks.

These outcomes came from proven Odoo payment automation solutions: signed webhooks, reference mapping, duplicate-safe retries, and dashboards that highlight exceptions early.

Why Choose Professional Odoo API Developers in the Netherlands

What experts bring:

- Local banking know-how (iDEAL issuers, SEPA formats, Giropay rules).

- Clean mappings across orders, invoices, refunds, payouts, and disputes.

- Strong security: signed webhooks, scoped API keys, and role control.

- Faster delivery with clear milestones, test cases, and runbooks.

- Post-launch monitoring and quick adjustments during the first closing cycle.

What you get:

Predictable posting, fewer support tickets, and confident reporting. Your team learns with live examples, not theory – using your orders, your journals, and your reports.

Common Challenges and How to Prevent Them

- Payment failures or sync gaps: Add signature checks, idempotency keys, and retry rules. Monitor webhook delivery and alert on drops.

- Incomplete refund paths: Map events end to end. Test partial refunds, full refunds, and reversals in sandbox and staging.

- Wrong or expired credentials: Store keys securely, rotate on a schedule, and restrict access by duty.

- GDPR risks: Mask personal data, limit roles, set retention windows, and log access.

- Chargeback confusion: Map issuer codes to dispute journals and add clear internal steps for evidence and timelines.

FAQs – Odoo API Integration for SEPA, iDEAL, and Giropay

Is Odoo API integration safe for EU payments?

Yes – when you use strong auth, signed webhooks, and strict role control. Odoo logs every event for audits.

Can SEPA and iDEAL run together in Odoo?

Yes. Both post consistent references and support refunds inside unified journals.

How long does Giropay integration take?

Most projects fit within the typical four-to-six-week window, depending on test depth and data readiness.

Do I need a developer for setup?

Yes. A specialist protects data, designs mappings, and prevents reconciliation issues that cost time and money.

Can Odoo automate refunds and billing?

Yes. Rules can trigger invoices, reminders, and refunds with full logs for finance and auditors.

Conclusion

Connecting SEPA, iDEAL, and Giropay to Odoo speeds cash flow, reduces errors, and gives teams clear daily visibility. Dutch companies close faster, answer payment tickets sooner, and expand cross-border sales with less friction. Finance gets clean references, predictable payouts, and better forecasts. Support works from one view with status, journal links, and refund history. Technical teams keep stable jobs, signed webhooks, and duplicate-safe retries. You get reliable posting during peaks and a calm month-end, even when volumes spike.

For a plan shaped to your stack and goals, talk to experts in Odoo customization services in Netherlands. Begin with one gateway, confirm results, then add more. Shiv Technolabs will map orders, invoices, refunds, and payouts, and train your team on live flows. We publish clear timelines, test real cases, and monitor early settlements. The result is faster reconciliation, fewer questions from auditors, and a setup your team can run with confidence.