Table of Contents

Cross-border banking has been criticized for inefficiencies. International transfers are cumbersome and require a number of days to settle, and the transaction costs are high since many intermediaries are involved.

Recent financial research claims that the average cost of a cross-border payment is almost 6% of the transaction value and may take two to five business days to process. Lack of uniformity in transparency and delays also contribute to customer frustration. Both businesses and individuals are exploring alternatives.

This is where the blockchain app development services come into play, providing a stable approach to make banking faster, cheaper, and more transparent. Blockchain in banking is more than a technological change, but a total revolution of the global payments process.

What Are the Current Challenges in Cross-Border Banking?

The current banking system operates based on an elaborate network of correspondent banking, old verification, and a multi-currency system. This renders any international payment a costly and time-consuming affair. We shall unpack the main points of pain.

- Expensive: Banks and intermediaries charge several layers of fees, which carve out of the real value transferred. A small business that remits money abroad tends to lose a large percentage of its profit margins.

- Slow Settlement: Traditional banking networks settle transactions in batches and require clearinghouses, resulting in delays of several days.

- Several Intermediaries: With each extra institution in the chain, there is an increase in risk of errors, exorbitant charges, and complexities in compliance.

- Fraud Risks: The lack of transparency and outdated infrastructure enable fraud to go undetected more easily.

Traditional Cross-Border Payments vs Blockchain in Banking

| Aspect | Traditional System | Blockchain in Banking |

|---|---|---|

| Speed | 2–5 days | Near real-time |

| Cost | High transaction fees | Significantly lower |

| Transparency | Limited visibility | Full transaction traceability |

| Security | Vulnerable to fraud | Strong cryptographic security |

How Does Blockchain in Banking Simplify Global Money Transfers?

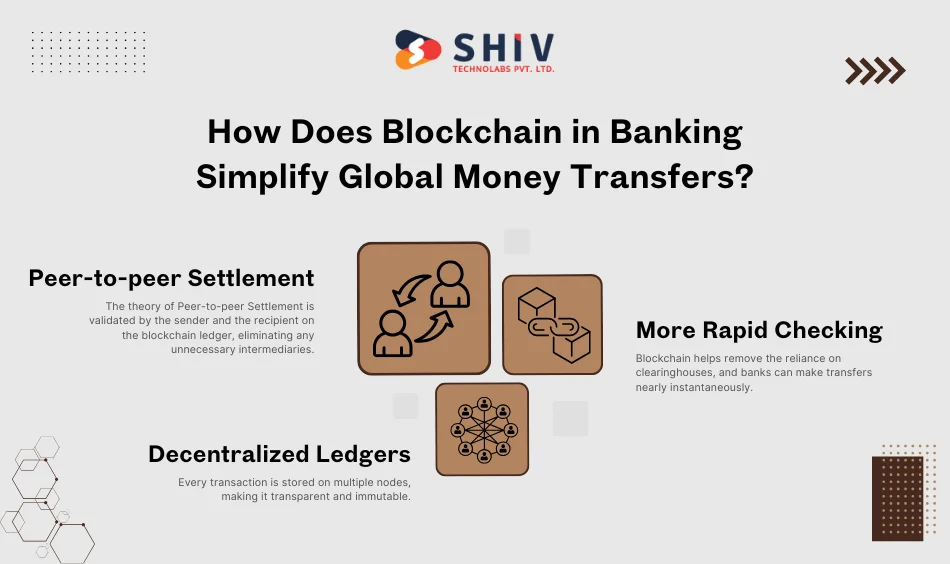

Blockchain implements a peer-to-peer, direct settlement system. Banks do not need to rely on a chain of intermediaries, as they can do so directly through a decentralized ledger. This makes it a faster, safer, and more cost-effective process for both banks and customers.

- Peer-to-peer Settlement: The theory of Peer-to-peer Settlement is validated by the sender and the recipient on the blockchain ledger, eliminating any unnecessary intermediaries.

- Decentralized Ledgers: Every transaction is stored on multiple nodes, making it transparent and immutable.

- More Rapid Checking: Blockchain helps remove the reliance on clearinghouses, and banks can make transfers nearly instantaneously.

Here are 5 Key Benefits of Blockchain Payment Solutions:

- Reduced transaction costs.

- Rapid settlements all over the globe.

- Record-keeping is immutable and transparent.

- Enhanced fraud prevention.

- International connectivity in the banking systems.

What Role Do Smart Contracts Play in Banking Transactions?

Smart contracts are computerized contracts that automatically execute under specific conditions specified. They transform the way compliance and payments are processed in the banking industry.

Automated Compliance: Smart contracts can be used to streamline AML and KYC compliance prior to payment processing. This minimizes mistakes and legal requirements.

Conditional Payments: Smart contracts in trade finance are available so that money is not transferred until goods are received and verified.

Use Cases of Smart Contracts

- Cross-Border Trade: Provides importers and exporters with automated settlement regulations.

- Remittances: Migrant workers remitting can benefit from quicker, cheaper, and safer remittance options.

- Corporate Banking: Automates the high-value settlements and makes them fully transparent to auditors and regulators.

What Banks are already utilizing Blockchain Technology?

The banking industry has ceased to be an experimental field with blockchain. Several international banks have already adopted blockchain technology in their business operations.

- RippleNet: RippleNet has been adopted by over 300 banks globally, making international transfers simple with almost instant settlements and reduced fees.

- Stellar: Stellar is used by banks and remittance operators to facilitate efficient micro payment and worldwide one-to-one money transfer.

- Santander: This is one of the European banks that introduced blockchain-based retail payment services.

- JP Morgan’s JPM Coin: Designed for institutional clients, JPM Coin enables fast settlement of interbank transfers.

Blockchain in Banking Sector

| Bank Name | Use Case | Blockchain Benefit |

|---|---|---|

| RippleNet | Cross-border transfers | Instant settlements, lower cost |

| JP Morgan | Interbank transfers | Secure and fast transactions |

| Stellar | Micropayments, remittances | Cost-efficient global access |

| Santander | Retail customer payments | Improved speed and transparency |

Finance Blockchain is no longer a science-fictional idea it is changing the way banks conduct business and the way their clients utilize financial services. Blockchain enables banks to optimise their operations by introducing transparency, speed, and security, as well as offering their customers effective and reliable financial solutions. We shall now take a closer look into the advantages of both sides.

Also Read: The Future of Blockchain

Cost Savings and Operational Efficiency for Banks

Conventional banking is characterized by more than two intermediaries, manual reconciliation, and time-consuming settlement processes, which are also costly. Banking blockchain applications also eliminate the middlemen who have become unnecessary and automate validation, enabling banks to handle cross-border payments at a fraction of the cost. Reduced operational overheads imply that banks can divert resources to innovation and customer services.

Faster Transfers and Settlements

Banks will be able to process transactions within minutes, rather than days, thanks to blockchain, which facilitates digital payments. Decentralized registers authenticate and resolve payments in near real-time, avoiding time-based delays and eradicating threats posed by time-sensitive operations. This not only enhances the customer experience but also strengthens the bank’s competitive advantage in international finance.

Enhanced Security and Fraud Prevention

Financial software development services help banks secure transactions. Blockchain makes all the records encrypted, unchangeable, and transparent. This decreases the chances of fraud, inappropriate access, or overspending.

Improved Transparency and Auditability

Each transaction on a blockchain can be viewed by authorized individuals, thereby providing an audit trail. Banks will easily follow up on all the transactions made to ensure compliance and customers will be able to follow their payments. Such openness makes people accountable and minimizes disagreements or mistakes in financial transactions.

Better Customer Experience

Banking applications based on blockchain provide speed, cheaper, and secure services to its customers. The convenience and reliability are created by the features, such as digital wallets, almost real-time transfers globally, and a confirmable transaction history. Customers will no longer need to tolerate the hidden charges or slow payment, and enjoy banking at a friendly and reliable speed.

Driving Innovation and Financial Inclusion

Through blockchain technology applications in the banking sector, financial institutions can introduce new products, integrate with fintech solutions, and reach new markets that were previously accessible. To customers, it translates to more customers being able to access financial services across borders, facilitating financial inclusion and closing the cross-border business gaps.

What Are the Barriers to Adopting Blockchain in Banking?

Although it has its benefits, banks face several barriers in adopting blockchain.

- Regulatory Issues in Various Geographic Locations: The various geographies have different compliance regulations, which create a challenge to the adoption of blockchain.

- Interoperability Problems: Banks often struggle to integrate blockchain solutions into their existing legacy systems.

- Infrastructure Cost and Scalability: The initial costs of development and deployment can be expensive, particularly for large institutions.

Key Challenges Slowing Adoption:

- Regulatory uncertainty.

- Absence of common blockchain specifications.

- High implementation costs.

- Opposition on the part of conventional financial institutions.

What Is the Future of Blockchain in Banking Apps?

The digital transformation and new fintech partnerships are the future of blockchain in banking.

- Central Bank Digital Currencies (CBDCs): Central banks and governments are considering blockchain-based national digital currencies to use in making safe payments.

- Fintech Partnerships: Banks are increasingly collaborating with fintechs to adopt blockchain solutions more quickly.

- Decentralized Banking Apps: Decentralized finance (DeFi) will continue to be integrated with conventional banking to offer new services.

Traditional System vs Blockchain Future Outlook

| Aspect | Traditional Banking | Blockchain Future Outlook |

|---|---|---|

| Settlement Speed | Days | Seconds |

| Costs | High | Low |

| Customer Trust | Moderate, intermediaries | Strong, transparent, peer-to-peer |

Conclusion

Blockchain in banking is transforming the cross-border payment system. It solves old inefficiencies in world finance by removing middlemen, facilitating almost real-time transfers, and by being transparent. Both banks and their customers can now access faster, cheaper and safer transactions.

Shiv Technolabs is the best blockchain app development company, developing blockchain payment solutions for businesses to streamline payments.

As a blockchain application development firm, we enable financial institutions and banks with secure, scalable, and future-ready solutions. Our team of tech experts is well-versed in blockchain app development for banking, which gives institutions a competitive edge to stay ahead in the global market.

When you count on us with your blockchain for digital payments requirements, our team of experts will assess your requirements and come up with the best solutions that help you stand out in the market. Get ready to set the stage for your customer with blockchain technology in banking sector.

FAQs

How does blockchain in banking improve cross-border transactions?

With blockchain in Banking, it is possible to have peer-to-peer transactions without intermediaries. This accelerates settlements that would take days now within minutes, and saves costs and enhances transparency, and worldwide transfer becomes easier and efficient for both the banks and the customers.

Can blockchain payment solutions reduce fees in international transfers?

Yes, payment services based on blockchain reduce the need for multiple banks and clearing houses. With the elimination of the middleman, the fees are minimal, which means more funds would reach the recipient with minimal expenses of transaction costs.

What are the key benefits of blockchain in finance for banks?

Banks are able to realize cost benefits, lesser fraud risks, enhanced compliance and are able to conduct global transactions faster. Financial blockchain also benefits the customers by providing them with more secure and reliable services.

Are blockchain banking applications secure for digital payments?

Yes, blockchain banking applications have high-level cryptographical security. All the transactions are secured in a ledger that cannot be changed or hacked to a great extent. This guarantees secure online transactions and secures customer confidence.

What is the future of blockchain in banking apps for global transfers?

The future includes rapid settlements, implementation of CBDC, fintech relationships, and decentralized applications. Blockchain will further transform customer expectations, making cross-border transactions smooth, inexpensive, and reliable.