Table of Contents

The transformation of the fintech sector has completely transformed Canada’s financial landscape, thanks to the innovative fintech solutions in Canada that are reshaping the way businesses and consumers engage with financial services. Fintech companies are engaging more with a custom software development company in Canada to build secure, scalable, and inexpensive solutions that comply with regulations and user expectations.

This guide details key considerations related to fintech solutions in Canada, including the cost of development, next-generation technologies, types of platforms, and compliance considerations that drive innovation. Whether it’s a start-up looking to rewrite the traditional banking experience or an existing business adopting digital solutions, an understanding of these issues will be a useful resource to make decisions when starting the fintech journey.

What Are Fintech Solutions in Canada and Why Do They Matter?

Fintech solutions in Canada are into an array of software-based technologies in the financial service industry, which improve and automate financial processes. These solutions are the digital payment platforms in Canada, wealthtech solutions in Canada, banking software solutions in Canada, mobile banking applications, peer-to-peer lending platforms, robo-advisors, and cryptocurrency exchanges.

The importance of fintech software in Canada is not only about technology development. To startups, these solutions offer a way to disrupt conventional financial institutions with their smart, user-friendly products and services.

What Do Fintech Development Costs in Canada Add Up To?

To determine the fintech development costs in Canada, it is important to look at project levels based on complexity and stages. Costs to build fintech solutions in Canada are somewhat related to regulatory obligations such as compliance with standards, regulatory security obligations, development integrations, as well as the scalability of the fintech application.

The process of development is multifaceted and involves numerous stages with key costs associated with each of the following: – Planning and Research (10-15% of costs), Compliance and Legal Framework (15-25%), Design and User Experience (15-20%), Development and Coding (40-50%), Testing and Quality Assurance (15-20%).

Cost Comparison Table: Fintech Development Investment Levels

| Project Type | Startup Level | Medium Enterprise | Large Enterprise |

|---|---|---|---|

| Basic Payment Platform | $50,000 – $100,000 | $100,000 – $250,000 | $250,000 – $500,000 |

| Digital Banking Solution | $100,000 – $200,000 | $200,000 – $500,000 | $500,000 – $1,000,000 |

| Wealthtech Platform | $75,000 – $150,000 | $150,000 – $350,000 | $350,000 – $700,000 |

| Compliance & Security | $25,000 – $50,000 | $50,000 – $125,000 | $125,000 – $250,000 |

Which Technology Trends Are Shaping Fintech Software in Canada?

There are many Canadian fintech startups leveraging AI to develop solutions and gain an advantage over their competitors. Banking software solutions in Canada now incorporate blockchain components to improve security and effectiveness. Cloud-native development is now a must-have for scalable fintech solutions in Canada, which allows companies to create dynamic, safe, and cost-efficient platforms that meet changing market needs.

Open banking APIs are changing how digital payment platforms in Canada and wealthtech solutions in Canada integrate with traditional financial institutions. This trend enables interconnectivity of data, as well as creating room for innovative financial products. Data security and privacy technologies are crucial in fintech software in Canada, with the introduction of advanced encryption, biometrics, and zero-trust security models into modern fintech solutions.

What Types of Fintech Platforms Are Canadian Businesses Investing In?

Diversification of investments across various fintech solutions in Canada is top on the list of strategies that businesses are adopting to serve the needs and wants of their customers better. The most prominent categories are as follows:

Digital payment platforms in Canada represent the largest investment category, including mobile payment solutions, contactless payment systems, and e-commerce payment gateways. These platforms help businesses to transact effectively as well as provide customers with convenient ways of making payments. Many Canadian fintech startups have excelled in this area by offering innovative payment solutions.

Wealthtech Solutions in Canada are experiencing great development as investors go for complex tools in wealth management, robo-advisory services, and automated investment platforms. These fintech solutions in Canada make investment management more democratic by offering individual investors professional-quality tools at a lower price.

Banking software solutions in Canada range from core banking systems, CRM platforms, to regulatory reporting tools. Traditional banks, as well as credit unions, are investing a lot in their infrastructure upgrading through fintech software in Canada in order to improve their operational efficiency and customer service. Other investment opportunities include lending and credit scoring platforms that utilize alternative data sources and AI, which help maintain fintech compliance with Canadian standards.

Why Is Compliance Critical for Fintech Growth in Canada?

The regulatory regime in Canada is made to safeguard the consumers and provide for the financial system stability, making it one of its crucial aspects.

Key regulatory frameworks governing fintech software in Canada include the Payment Card Industry Data Security Standard (PCI DSS), OSFI guidance in this area for banking software solutions in Canada, and the Personal Information Protection and Electronic Documents Act (PIPEDA) for data processing.

It is also important to note that compliance with the fintech requirements in Canada causes a big influence on development timescales and fintech development costs in Canada, as solutions should consider security measures, audit trails, and reporting capabilities widely. Nevertheless, this compliance framework promotes consumer trust, which is an essential precondition for user adoption and business growth.

Many Canadian fintech startups engage specialized custom software development services in Canada that understand the regulatory framework of the country and build compliance integration directly into their solutions.

How Are Canadian Fintech Startups Driving Innovation?

Canadian fintech startups are leading the charge in financial innovation, showing a preference for unique market and regulatory positions that Canada’s ecosystem provides. These startups find great headway, especially in areas where they can provide far better user experience than traditional financial institutions.

In the payments sector, Canadian fintech startups are leading the development of new digital payment platforms in Canada that have features such as instant transfers, lower fees, and better security. Weathtech solutions in Canada represent another subsector where start-ups play a huge role by democratizing investment management through robo-advisory services, automated portfolio rebalancing, and low-cost investment platforms.

The success of Canadian fintech startups often arises from their ability to identify the gaps in the market and develop fintech solutions in Canada on the basis of specific pain points. Many collaborate with custom software development services in Canada to build solid, scalable platforms.

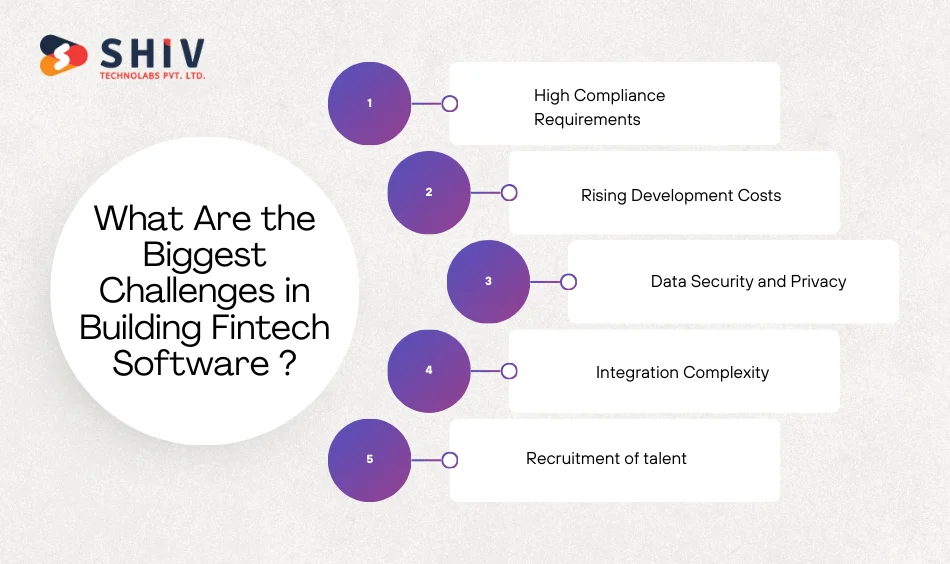

What Are the Biggest Challenges in Building Fintech Software in Canada?

In order to successfully build fintech software Canada, there are a lot of challenges that need to be navigated so that project timelines, costs, and market success are not affected:

- High Compliance Requirements: Fintech compliance Canada standards impose various security procedures, audit tasks as well as regulatory reporting tools which may significantly increase fintech development costs in Canada.

- Rising Development Costs: The cost of building fintech applications in Canada is increasing due to the shortage of experts, complex security requirements and specialized expertise needs.

- Data Security and Privacy: Fintech solutions in Canada should implement enterprise grade security measures to protect sensitive financial information. This requires advanced encryption and continuous monitoring system.

- Integration Complexity: Banking software solutions in Canada is very demanding because the existing legacy systems are too rigid to support even new and simple applications. This trend has created many complex issues which can only be addressed by specialized expertise.

- Recruitment of talent: It can be challenging and expensive to find developers with expertise in both financial technology and Canadian regulatory requirements.

Many firms address these challenges by engaging with the proven custom software development partners in Canada, like Shiv Technolabs, that specialize in fintech solutions in Canada and understand unique Canadian market requirements.

Which Factors Should Businesses Consider Before Choosing a Fintech Platform?

There are many factors that need to be considered when it comes to fintech solutions in Canada that have the potential to determine long-term success and user adoption. Here are some key considerations:

- Security and Compliance: Ensure that the fintech compliance of the platform satisfies all Canadian regulations and includes security measures satisfying standards such as PIPEDA, PCI DSS, and OSFI.

- Integration Capabilities: Understand the level of integration of Canadian banking software solutions with existing systems, banking API’s and other third-party capabilities to assist with implementation.

- Scalability and Performance: Invest in fintech solutions in Canada that can support the predicted growth of users and transaction volumes, primarily important for digital payment platforms in Canada and wealthtech solutions in Canada.

- User Experience Design: Give priority to platforms that come with interfaces that are intuitive and responsive, and can be used on different devices, as the user experience is a major factor influencing adoption rates.

- Cost Structure: Evaluate the total cost of ownership, which includes licensing fees, implementation costs, ongoing maintenance, and the scaling expenses related to the cost of building fintech applications in Canada.

Many businesses benefit from partnerships with an experienced custom software development company in Canada that can provide advice and guidance when it comes to platform selection and implementation strategies.

What Does the Future of Fintech in Canada Look Like?

The future of fintech in Canada is very bright and promising on many fronts, which points towards a trajectory of accelerated growth and innovation. Canadian fintech startups are on the verge of taking lead positions in setting global financial technology trends while serving domestic markets’ needs.

AI and ML will be more integrated into fintech solutions in Canada, enabling personalized solutions on a more sophisticated level, to assess risks better and support automated decision-making. Cross-border payments, together with international financial services, represent significant growth opportunities for digital payment platforms in Canada and banking software solutions in Canada.

Why Partner With Us for Fintech Solutions in Canada

Shiv Technolabs is one of the leading custom software development companies in Canada, specializing in tailored fintech solutions in Canada that are fully compliant, cost-effective, and help businesses grow. The company’s expertise spans digital payment platforms in Canada, wealthtech solutions in Canada, and banking software solutions in Canada.

The team at Shiv Techolabs is well-positioned to understand the unique challenges of fintech development costs in Canada, and works on maximizing your investment through an effective development approach alongside deep expertise in fintech compliance Canada requirements. As one of the leading custom software development companies in Canada, Shiv technolabs has successfully delivered projects for emerging Canadian fintech startups and established financial institutions.

Key advantages of partnering with us:

- Regulatory Expertise: Deep understanding of fintech compliance Canada standards ensuring your solution meets necessary regulations from launch

- Scalable Architecture: We design fintech software Canada with growth in mind, utilizing cloud-native technologies that scale efficiently

- Security-First Approach: Implementation of enterprise-grade security measures that protect user data and financial transactions

- Proven Track Record: Extensive portfolio of successful fintech solutions in Canada across multiple financial sectors

- Cost-Effective Solutions: Transparent pricing and efficient development processes that optimize the cost of building fintech applications in Canada

Conclusion

There is an ongoing transformation of fintech solutions in Canada, and this is attributed to the technological innovation that makes it possible as well as changing consumer expectations that are shaping this market. Numerous Canadian fintech startups have shown that fintech software in Canada can successfully outcompete established financial institutions and, at the same time, satisfy specific market needs. The growth of these companies, as well as increased interest in digital payment platforms in Canada, wealthtech solutions in Canada, and banking software solutions in Canada, implies a good course for the sector.

FAQs

What are the most common fintech solutions in Canada?

The leading fintech solutions in Canada include digital payment platforms in Canada, wealthtech solutions in Canada, and banking software solutions in Canada. Other common solutions include lending platforms, insurance technology, and regulatory compliance tools that assist businesses in complying with fintech requirements in Canada.

How much does building fintech applications cost in Canada?

The cost of building fintech applications in Canada completely depends on complexity. Basic payment platforms can cost from $50,000 to $500, 000, while comprehensive banking solutions can cost $100,000 to $1,000,000. Fintech development costs in Canada depend on compliance requirements, safety features and scalability needs.

Why is fintech compliance important in Canada?

Fintech compliance in Canada ensures consumer protection and maintains the stability of financial systems along with building the essential trust for user adoption. Compliance regulations in Canada yield competitive advantages and long-term viability.

Which technology trends define the future of fintech in Canada?

The future of fintech in Canada is shaped by AI, blockchain technology, cloud-native development, and open banking APIs. These trends set the stage for innovations among Canadian fintech startups and create superior financial technology solutions for Canada.

How do Canadian fintech startups compete globally?

Canadian fintech startups compete by focusing on underserved markets, using their regulatory advantages, and creating innovative fintech solutions in Canada that address specific local needs. Many of them partner with specialized custom software development services in Canada in order to build solid platforms while maintaining competitive costs and a deep understanding of fintech compliance Canada standards.