Table of Contents

Tired of monthly spending guesswork and surprise fees that wreck your plan every few weeks? If you plan a budgeting app like Mint, partner with a mobile app development company in usa. You gain careful planning, clean code, and reliable timelines that reduce risk and speed your entry with confidence.

Mint proved that simple flows, clear copy, and fresh data can change habits at scale. We follow that model and add stronger goals, subscription checks, and timely alerts that prevent fees. Think quick onboarding, accurate categories, and a dashboard that answers real questions in seconds for users and teams.

Bank links refresh on a steady schedule, while smart nudges keep people on track through the month. Privacy, consent, and audit trails sit at the core from day one to build daily trust. In this guide, you’ll learn how to plan features, estimate costs, and ship safely in phases.

How does a budgeting app like Mint work for US users?

Bank links, consent, and refresh cycles

The app connects to bank accounts through approved US aggregators after clear consent. It reads balances and transactions on a set schedule. It tags merchants, assigns categories, and groups repeats, so people see patterns without manual work. For aggregator work and bank data flows, anchor your stack in solid fintech development services.

Real-time budgets, alerts, and bill tracking

Budgets update as new transactions arrive. Users set caps for groceries, fuel, and dining, then track progress each day. Alerts flag bill due dates, low balances, large charges, and price jumps on subscriptions.

Accuracy, retries, and re-auth

Links can fail, tokens can expire, and webhooks can lag. Add retry logic with backoff and simple re-auth screens. Keep a clear trail for audits and support teams. Build these paths with custom API development to handle signatures, idempotency, and event ordering.

Privacy and clear permissions

Show what the app reads and why. List vendors that process data and how to revoke access. Plain copy lowers fear and cuts support tickets.

US laws and partner reviews

Plan for PCI DSS, GLBA, SOC 2, and CCPA in the US. Add GDPR if you serve EU users. Use least-privilege access and keep audit logs for key actions.

Quick glossary

- PCI DSS: Payment Card Industry Data Security Standard

- GLBA: Gramm-Leach-Bliley Act

- SOC 2: Security and availability report for service providers

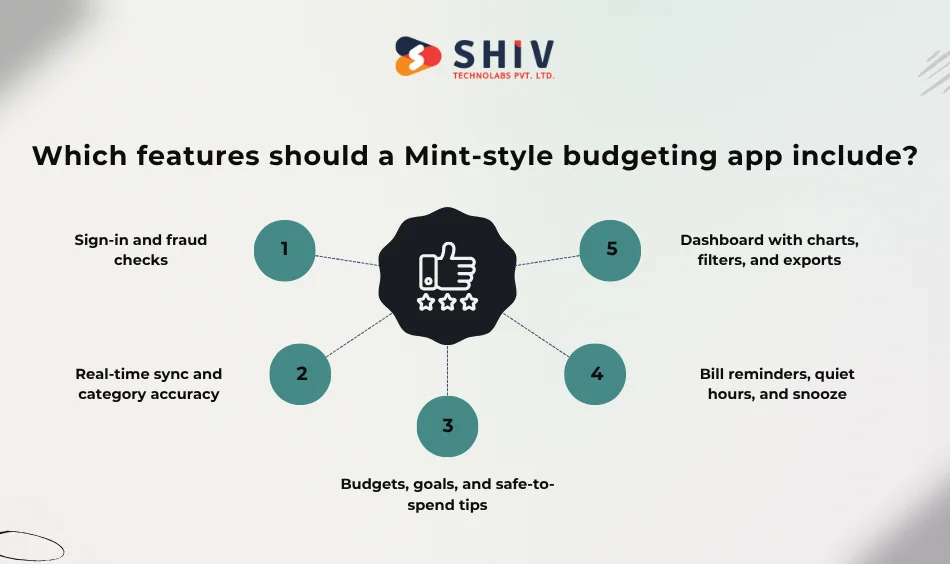

Which features should a Mint-style budgeting app include?

Sign-in and fraud checks

Use MFA and biometrics with strong transport and storage encryption. Add device checks, risk scores, and rate limits that slow bots yet keep real users moving. Keep recovery simple with backup codes and verified email or phone.

Real-time sync and category accuracy

Refresh on short, predictable intervals through aggregators like Plaid or Yodlee. When calls fail, retry and log the attempt. Merchant cleanup and learning rules keep views tidy and totals correct.

Budgets, goals, and safe-to-spend tips

Let users set caps, saving targets, and sinking funds in a few taps. Payday-aware nudges help pace spending through the month. Use clear text like “Left this month” and “Safe to spend.”

Bill reminders, quiet hours, and snooze

Time alerts to post dates and user preferences. Quiet hours stop late-night pings. One-tap snooze keeps attention on the current task while still avoiding fees.

Dashboard with charts, filters, and exports

Show cash flow, category splits, and net position on one screen. Add filters for date range, merchant, and account type. Offer CSV and PDF exports for taxes and family planning. For charts and data grids, lean on front-end development services.

AI insights with plain reasons

Group similar purchases and project the month-end spend. Flag rising subscriptions and odd spikes. Add a short reason for each tip, so people trust and act.

iOS, Android, and web without state loss

People switch devices during the day. Recover sessions fast and replay queued actions on reconnect. Keep layouts consistent, so habits carry over. Cross-platform teams often start with a React Native app development company USA; some choose Flutter app developers USA for the same goal.

Shared profiles and permissions

Money often involves families. Offer shared budgets, read-only roles, and teen views. Explain what each role can see or change.

Security pattern that works in production

Use TLS 1.3 for clients and short-lived tokens after consent. Store sensitive fields with AES-256. Keep keys in a managed KMS with rotation. Sign webhooks and guard against replay.

Support flows that actually help

Make “Dispute a charge,” “Fix a category,” and “Relink account” easy to find. Attach context to tickets for agents. This cuts handling time and protects ratings.

Accessibility and plain language

Keep high contrast, large tap targets, and voice-over support. Replace jargon with short, direct phrases. More users finish tasks on the first try.

Revenue paths that respect trust

Free plus premium works well here. Keep the free tier useful. Offer premium insights, family sharing, and deeper reports without tricks.

How much does it cost to develop a budgeting app in USA, and what drives the budget?

Costs shift with scope, platforms, security depth, and aggregator work. Plan phases that protect quality and tie spend to outcomes. A lean MVP with core features often ranges $25,000–$40,000 on one shared codebase. A growth build with reports and alerts often lands at $40,000–$70,000. A rich build with web and AI can reach $70,000–$120,000.

Budget breakdown table

| Item | Estimated Cost (USD) | Scope |

|---|---|---|

| Design & Discovery | $3,000–$7,000 | Wireframes, prototypes, quick user tests |

| App + Backend Build | $16,000–$35,000 | Cross-platform app, APIs, DB, account linking, budgeting |

| Security & Compliance | $3,000–$6,000 | Encryption, PCI DSS/CCPA/GLBA basics, audit logs |

| QA, DevOps & Launch | $8,000–$15,000 | Testing, CI/CD, monitoring, store listing, analytics |

| Maintenance (yearly) | $2,000–$5,000 | Updates, SDK upgrades, bug fixes |

Third-party fees sit outside the build cost and depend on usage tiers. Plan for aggregator, App Store, and Play Console fees. Add periodic security reviews and legal checks during scale-up.

What drives the number up or down?

App complexity and features

Scope moves the number the most. Core features cover linking, categories, budgets, reminders, and a clean dashboard. Advanced layers—AI tips, card alerts, family profiles, offline queues, and role control—add time and testing.

Platform choice

A single codebase trims cost and speeds updates. React Native or Flutter fits most US consumer apps. Fully native builds suit device-specific needs or heavy graphics. A web portal helps admins and support but adds testing and hosting work.

Design quality and UX

Clear flows reduce churn and support tickets after launch. Test copy and prototypes before you code. Strong empty states and helpful defaults guide action without extra taps.

Bank and API integrations

Connect through Plaid, Yodlee, or similar US aggregators. Handle consent, token refresh, re-auth flows, webhooks, and retries. Expect extra work for multiple banks, joint accounts, and subscription detection.

Security and compliance level

Add MFA, encryption, least-privilege access, and detailed logs. PCI DSS, SOC 2, CCPA, and GLBA add code, documents, vendor review, and audits. Security depth affects both schedule and cost.

Team model and schedule

Parallel streams cut time but raise team cost. Strong acceptance criteria limit rework. Reusable parts and clear standards keep future changes faster and safer.

Rollout plan that reduces risk and speeds learning

Phase 1: Link and show value

Ship linking, categories, budgets, and a clean dashboard. Add a short guide with three tasks users can finish in five minutes.

Phase 2: Alerts and reports

Add bill reminders, low-balance alerts, and a simple cash-flow report. Improve category rules from real data. Keep alert text short and specific. For multi-tenant controls and billing, lean on a SaaS development company.

Phase 3: AI insights and card alerts

Group similar buys, watch subscription drift, and project month-end spend. Explain each tip in one or two lines. Add card alerts if you work with banks or card programs.

Phase 4: Web and shared profiles

Add a web portal for families and power users. Offer shared budgets and read-only roles. Provide export and print views for taxes and planning.

Phase 5: Growth and pricing

Test premium tiers with deeper insights and family features. Add two-sided referral hooks. Place prompts after success moments, not during onboarding.

Day-one operations and support

Monitoring and logs

Track aggregator latency, webhook failures, and category error rates. Alert on token churn and broken institutions. Good signals help you fix issues before reviews dip.

Incident playbooks

Write steps for “link down,” “slow refresh,” and “bad category.” Give agents clear scripts and next actions. Calm replies protect trust during spikes.

Data hygiene

Run nightly checks for duplicate merchants, broken splits, and missing links. Small daily fixes keep charts stable. Users wake up to clean data.

Performance and caches

Cache popular charts and totals per user. Bust caches on new webhooks. Keep cold starts short on server functions. Fast screens build habits.

Why Choose Shiv Technolabs

Shiv Technolabs builds finance apps that handle bank links, webhook timing, and merchant cleanup with care. We ship stable Node.js services and React Native or Flutter apps. We add clean Plaid or Yodlee links with strong logs and alerts. Our team writes readable code, ships on a steady rhythm, and tracks the right metrics after release. You get quick updates, safer changes, and reliable ops at scale.

We plan short phases with outcomes you can measure. Each sprint ends with a working demo. We test hard parts early—link, re-auth, and dispute paths—so your first users see a polished core.

Conclusion

Winning in the US market starts with a tight core: accurate links, clean categories, and alerts that prompt early action. Pair these pillars with plain consent screens, role-based access, and steady performance on iOS, Android, and web. Ship in stages, learn from real use, then add depth when retention proves the next step.

Keep a clear view of costs and cut the scope that adds little daily value. Build strong support and monitoring, so issues do not linger. For tailored delivery and faster growth, partner with Shiv Technolabs – experts offering mobile app development services in usa – so your product launches right and grows with confidence.

FAQs: Building a Budgeting App Like Mint

How long does a Mint-style budgeting app take to build?

Most MVPs land in four to six months, depending on scope, approvals, and team size.

Which stack fits US finance apps best?

React Native or Flutter for mobile, Node.js or Python for backend, and Plaid or Yodlee for bank links.

How do we keep financial data safe inside the app?

Use MFA, encrypt traffic and storage, limit access by role, and audit controls against PCI DSS, CCPA, GLBA, and SOC 2.

Can one integration cover most US banks and cards?

Yes. Leading aggregators offer broad coverage; plan for consent, token refresh, re-auth screens, and reliable retries.

What factors move the budget most?

Feature scope, platform count, aggregator work, and compliance depth. A single codebase and phased releases help control spend without cutting quality.