Table of Contents

The manual management of property finances is no longer effective. The Odoo solution for real estate will help finance departments automate reporting, monitor revenue, and analyse expenses in real time.

Financial management in real estate is changing rapidly, and companies that rely on spreadsheets, fragmented systems, or snarled reporting are becoming relics. Industry data indicate that the global real estate ERP market is expected to grow by 8% by 2030, suggesting a strong propensity towards digital transformation.

To the finance departments of real estate companies, it is time to say goodbye to days of manual entries, incomplete data, and responses to decisions that take time to be processed. Using an Odoo financial management system, teams can achieve automation, accuracy, and a real-time dashboard that provides clarity.

This article will unravel how Odoo, as a real estate finance solution, can make your workflows, like manual reports to smart dashboards, easier, and reveal the essential modules, the implementation process, advantages, price estimates, and the process of selecting the proper partner.

Why Do Real Estate Finance Teams Struggle with Manual Reporting?

Finance departments in real estate face their own unique stress: multiple properties, varied sources of income and leases, investor reporting, maintenance expenses, and regulatory requirements. When reporting is done manually or through disconnected tools, the risk of errors, delays, and poor visibility is extremely high.

What Are the Main Pain Points in Traditional Financial Management?

You will encounter some common challenges in most real estate firms: laborious data entry, disjointed systems, and delays in asset consolidation.

Top 5 problems caused by manual reporting in real estate finance

- Monotonous data entry mistakes.

- Missed payment cycles

- No real-time visibility

- Absence of consolidated financial reporting.

- Poor decision-making speed

Those problems can disable a finance department from reacting promptly, making budgets, or predicting revenue. The head-on problems can be countered by the use of an Odoo accounting software in real estate, which automates entries and standardizes the data, and offers real-time dashboards. It is not only a question of how to manage real estate finances with Odoo, but also when your team will make the transition.

How Does Odoo Transform Real Estate Financial Management?

Implementing an Odoo financial management system would entail replacing manual, static reports with dynamic, intelligent reports. The transformation cuts across automation, integration, and real-time.

Live Dashboards including Visual Insights

Rather than waiting until the end of the month reports, the finance teams can track key metrics at a glance. Income, expense trends, occupancy rates, and cash flow are displayed in real time with visual widgets in an Odoo finance dashboard. Such visibility transforms the discussion of what happened into what’s next.

Automated Entries and Reconciliations

Journal entry, expense allocation, and reconciling across leases and properties —these activities take hours every month and are also prone to errors. Odoo real estate finance automates entries; Odoo provides the entity with a solution that triggers reconciliation and links invoices to lease contracts, and creates uniformity. Precision is enhanced significantly.

Centralised Multiple-Project or Multiple-Property Data

Consolidating financials may be a nightmare when you have a portfolio with several buildings, regions or asset types. Odoo has a single source of data. You can draw consolidated reports across projects or view them at the property level.

Key Financial Features in Odoo vs Manual Systems

| Feature | Manual Reporting | Odoo Financial Management System |

|---|---|---|

| Data Accuracy | Prone to errors | Real-time validation |

| Speed | Slow report generation | Instant dashboard updates |

| Forecasting | Limited | AI-powered analytics |

| Expense Tracking | Manual spreadsheets | Automated workflow |

| Accessibility | On-site only | Cloud-based anytime access |

The process of migrating to Odoo for real estate finance is not only about new tools but also about how you manage, respond, and lead. Finance departments that used to scramble to get monthly data are now able to focus on strategy and planning.

What Are the Core Odoo Modules Used in Real Estate Finance?

In developing a custom Odoo financial management system for real estate, certain modules are essential. They are accounting, billing, CRM, project cost control, and predictive analytics.

Essential Odoo Modules for Real Estate Finance Teams

- Accounting Module – to make journal entries, ledgers, and reconciliation.

- Invoicing Module- to invoice rent and maintenance automatically.

- CRM Module – to monitor the buyers and investors of the property.

- Project Module – to control the budget of construction.

- AI dashboard Module: predictive financial analysis.

All these blocks contribute to reducing manual labor and increasing clarity. For example, the invoicing module will streamline manual rent billing, the project module will provide cost-tracking for construction or refurbishment, and the AI dashboard module will transform historical data into predictive insights. Selecting the appropriate Odoo accounting software for real estate ensures finance departments have control and full visibility.

How to Manage Real Estate Finances with Odoo Step-by-Step

The following is a step-by-step guide for finance teams to implement. When you have questioned how to build a go-live plan for Odoo to serve real estate finance, the following steps will be of assistance to you in gaining momentum and realizing value early on.

The following is a step-by-step guide for finance teams to implement. If you work with an experienced Odoo implementation partner, these steps move faster and stay structured.

Step 1 – Automate Invoicing and Payments

Begin with frequent invoices for tenants or clients. Automate Odoo to generate rent or maintenance bills. Then connect with payment gateways to have collections updated in real time.

Step 2 – Property-Wise Financial Data Centralisation

Breakdown of a project, building, or asset class financials. Property-level P&L, balance sheets, and cost centres can be captured with Odoo. This provides you with macro and micro visibility.

Step 3- Monitor Cash flow and predict revenue

Monitor receipts or payments using your Odoo finance dashboard. Predict rent collection patterns, investor dividend, and building repair expenses. Potential problems are realized sooner.

Step 4- Profitability Analysis using Dashboards

Establish key performance indicators (KPIs) concerning income, expenses, occupancy rate, investor returns, and cost fluctuation. Automate your Odoo dashboard to send monthly reports and insights to your staff.

This order will ensure the finance team experiences early wins and builds confidence, developing and adding complexity throughout the process. The insight into managing real estate finances using Odoo implies that you provide operational enhancements and strategic clarity.

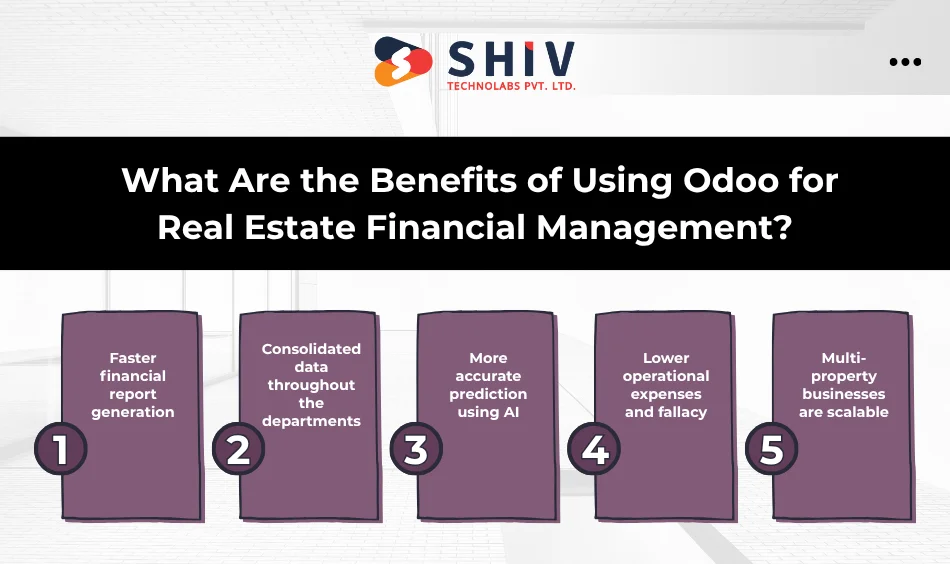

What Are the Benefits of Using Odoo for Real Estate Financial Management?

Whenever finance teams go on an Odoo financial management system, the results become measurable and quantifiable. We will go through the best advantages.

- Faster financial report generation: Standardised information and automated processes allow reports to be prepared in minutes rather than days.

- Consolidated data throughout the departments: The single platform eradicates inconsistencies, and teams operate with the same set of data.

- More accurate prediction using AI: The Odoo finance dashboard predictive modules are able to track the trends and risks in the future.

- Lower operational expenses and fallacy: Automation reduces manpower and errors, and personnel time is redirected towards analysis rather than data entry.

- Multi-property businesses are scalable: As you expand your portfolio, Odoo scales with you, no longer starting all over again.

In real estate companies, such advantages imply that finance departments will cease to be reactive and become proactive. They are not merely shutting books; they are making a strategy. That is the essence of the advantages of Odoo in the financial management of real estate.

How Much Does It Cost to Implement Odoo for Real Estate Accounting?

The first question is usually cost. This is a realistic perspective of investments at various business sizes to be able to budget and plan.

| Business Size | Scope | Estimated Cost (USD) | Timeframe |

|---|---|---|---|

| Small Agency | Basic accounting setup | $3,000–$7,000 | 2–4 weeks |

| Mid-Size Developer | CRM + Finance + Dashboard | $8,000–$15,000 | 4–8 weeks |

| Enterprise Group | Full ERP + AI integration | $20,000+ | 8–12 weeks |

These are approximate figures of what the real estate accounting implementation cost of Odoo can resemble. Real cost is based on the quantity of users, modules chosen, customisations, data migration and training. With proper planning and choosing a partner who has experience in the sector you will be in you will keep the surprises to minimum.

How to Choose the Right Partner for Odoo Finance Implementation?

The choice of the implementation partner is just as critical as the software one. To deploy a real estate finance, you will need experience, depth of domain and support attitude.

Key Qualities to Look for in an Odoo Expert

- Real estate automation experience.

- Established financial management module knowledge.

- Customisation capability of dashboards and reports.

- Post-deployment support

- Pre-Hiring Questionnaire Odoo Partner.

- Investigate past real estate ERP projects.

- Inquire about accounting module experience.

- Check the schedule and post-launch support.

You avoid some pitfalls when you collaborate with a team that is knowledgeable about your industry and familiar with Odoo as a tool in real estate finance. You will have an easier deployment, greater user adoption, and more expeditious ROI. When doing a comparison, seek demonstrated experience in the Odoo financial management system in the real estate business.

Conclusion

Finance departments no longer have to rely on the old-fashioned spreadsheets or isolated software. Odoo enables real estate companies to have single-source dashboards, automation, and analytic insights to support decision-making. At Shiv Technolabs, we specialize in the deployment of Odoo for real estate finance, including custom modules, dashboard design, and maintenance.

As a reliable Odoo Development Company, we will guide you through unconventional operational methods to smart financial management. When you are ready to take your finance operations to the next level, reach out to us today and find out how we can create a scalable, high-performing Odoo financial management system for your real estate business.

FAQs

Q1. How does Odoo help real estate finance teams reduce errors?

Odoo enables all financial information to flow through related modules, replacing manual entries with automation. This synchronisation removes discrepancies, enables real-time payment reconciliation, and creates a single source of truth for your finance team.

Q2. Can Odoo handle multiple real estate projects at once?

Absolutely. Odoo enables finance departments to identify financials by property or project, assign cost centres, track budgets per asset, and report consolidated portfolios, all within a single system designed to scale for real estate.

Q3. Is it expensive to implement Odoo for real estate accounting?

The cost of implementation will rely on modules, the level of customisation, and the data migration involved. It is an investment that many firms can afford, since smaller agencies can start small and grow into larger budgets.

Q4. What dashboards can be created in Odoo for real estate finance?

Finance departments will be able to develop rent collection trend dashboards, expense management dashboards, occupancy dashboards, property-wise profitability, investor reporting, and projections of income. Such visual aids make the decision-making process more transparent and faster.

Q5. Does Odoo support AI-based financial predictions?

Yes. Odoo, with the appropriate modules and data set, can predict revenue, cost risks, and investment opportunities, which is useful because it helps finance teams shift their focus towards strategic rather than reactive decisions.