Table of Contents

Mobile users in the UAE expect fast, secure checkout every single time. Our mobile app development services in UAE place payments at the center of product planning. We design flows that cut drop-offs, raise approvals, and keep billing stable during busy sales periods.

Digital payments now drive eCommerce, delivery, travel, and subscription apps across the country. The right payment gateway for mobile apps in the UAE supports cards, wallets, and BNPL while keeping fees and risks in control. Our teams plan integrations with clean APIs, clear logs, and reporting that your finance team can trust.

A well-built stack also supports loyalty credits, refunds, and installments without breaking your roadmap. It lets you ship new offers and pricing tests with less rework and fewer billing issues. With this foundation, growth plans move faster and customer confidence stays high across campaigns.

But which payment gateways work best for UAE apps, and how much does integration really cost?

Why Secure Payment Gateways Matter for UAE Mobile Apps

Security protects revenue, brand reputation, and long-term retention. Every transaction carries sensitive card and identity data that must stay private. A weak link can trigger disputes, legal exposure, and instant churn that hurts future marketing returns.

UAE acquirers favor 3D Secure, tokenization, and real-time risk checks that stop fraud early. These controls confirm the cardholder, lower chargebacks, and keep approval rates healthy during peak traffic. Customers see familiar prompts, such as one-time passwords or biometrics, which builds confidence at the moment of payment.

Payment rules differ by business model. Delivery apps value fast captures and easy refunds, while retail apps need strong dispute handling. Service and subscription apps often require partial captures, retries, and card updater support to reduce failed renewals.

When workflows get complex, custom payment integration for apps in the UAE prevents brittle workarounds. Examples include split payouts for marketplaces, vouchers with expiry logic, and staged settlements tied to order status. We document these flows, implement audit trails, and keep sandbox policies clear for product and QA teams.

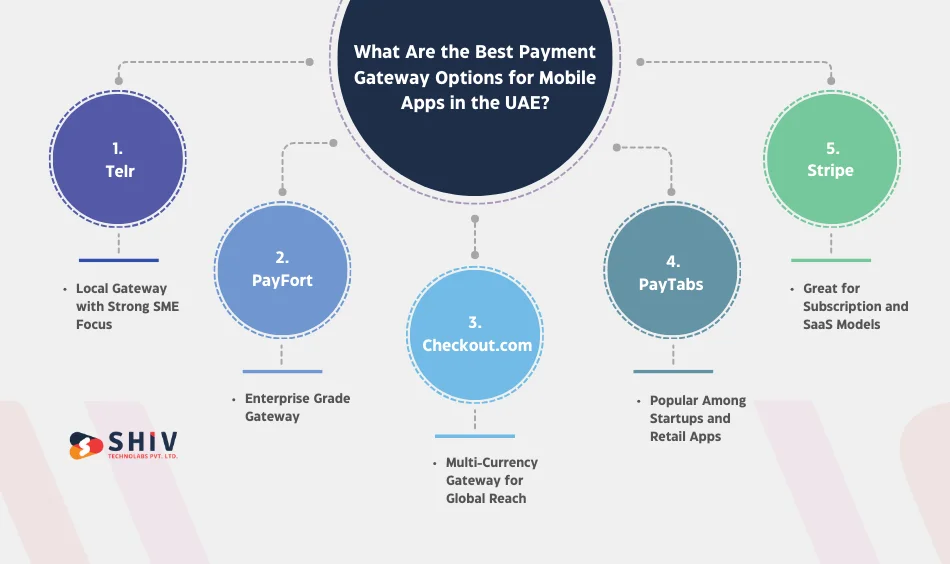

What Are the Best Payment Gateway Options for Mobile Apps in the UAE?

Several providers stand out in the region for reliability, API quality, and local support. The best payment gateway option for mobile apps UAE depends on your currencies, billing model, and reporting depth. We help product, engineering, and finance teams align on a gateway that fits real goals.

1. Telr – Local Gateway with Strong SME Focus

Telr is a practical choice for SMEs that want quick onboarding and fair pricing. It supports 3D Secure, saved cards, refunds, and local settlement that matches regional accounting needs. Teams get clear dashboards, mobile SDKs, and webhooks that simplify daily monitoring.

We recommend Telr for stores and delivery apps that need fast approvals and COD-friendly processes. Finance teams gain better visibility on payouts and fees, while developers work with straightforward endpoints. The result is a stable checkout that supports promotions and seasonal volume without surprises.

2. PayFort (Amazon Payment Services) – Enterprise Grade Gateway

Amazon Payment Services suits high-volume brands with complex risk and billing needs. Enterprises value installments, recurring billing, and chargeback tools built for campaign spikes. Engineering teams get mature APIs, tokenization, and retry logic that support global routing.

Our integrations add clear error handling, partial captures, and solid reconciliation paths for finance. The setup holds steady during flash sales and major launches, which protects revenue during your most visible moments. For regional groups, cross-market reporting helps leaders compare fees, approvals, and disputes easily.

3. Checkout.com – Multi-Currency Gateway for Global Reach

Checkout.com fits brands that sell across borders and need consistent approval rates. It supports many currencies, local methods, and smart routing that raises successful authorizations. Product teams gain clear analytics that guide pricing tests, rollout timing, and regional forecasts.

Developers work with stable APIs, dependable webhooks, and mobile SDKs that fit modern stacks. Finance teams get better visibility on settlements, fees, and disputes across multiple markets. This balance of features and reporting helps leaders make accurate, data-driven decisions quickly. (More on multi-currency flows in our travel payments guide.)

4. PayTabs – Popular Among Startups and Retail Apps

PayTabs appeals to startups and retail apps that want quick setup and strong local support. It offers card payments, popular wallets, and helpful fraud checks that protect new brands. Documentation is straightforward, which reduces early integration mistakes across iOS and Android builds.

Merchants appreciate easy refunds, recurring billing options, and practical dashboards for daily tasks. PayTabs also supports Arabic and English flows that suit regional buyer preferences. For teams moving fast, this combination helps shorten launch timelines without cutting key controls.

5. Stripe – Great for Subscription and SaaS Models

Stripe stands out for subscriptions, metered billing, and flexible invoice logic. The stack supports trials, coupons, and dunning flows that protect recurring revenue at scale. Global reach, clear logs, and strong developer tools make rollout and iteration more predictable.

Mobile teams like consistent SDKs and webhooks that handle lifecycle events reliably. Finance benefits from clean reports, exports, and reconciliation paths that match audit needs. Stripe can also sit alongside a local gateway for mixed regional and global strategies.

Comparison of Top Payment Gateways in the UAE

| Payment Gateway | Best For | Setup Cost (AED) | Key Features | Local Support |

|---|---|---|---|---|

| Telr | SMEs, E-commerce | 500–1500 | 3D Secure, COD options | Yes |

| PayFort | Large Enterprises | Custom Quote | Fraud control, Installments | Yes |

| Checkout.com | Global Businesses | 0 Setup | Multi-currency, Analytics | Yes |

| PayTabs | Startups | 0–1000 | Quick setup, API-ready | Yes |

| Stripe | SaaS & Subscriptions | Free | Easy API, Global reach | Limited |

Costs may vary by transaction volume, settlement rules, and custom features.

How to Integrate a Payment Gateway in Your Mobile App (Step-by-Step)

A clean rollout reduces failures, improves approvals, and shortens support tickets. When you integrate a payment gateway in a mobile app, plan for security, testing depth, and clear rollback paths.

Step 1 – Select a Payment Gateway That Matches Your Business Model

Map your use cases before shortlisting providers. List currencies, payment methods, refunds, disputes, and subscription needs in writing. Confirm SDK quality, webhook reliability, and settlement timelines that match your finance calendar.

Step 2 – Get API Access and Sandbox Credentials

Request keys for test mode and production with correct permission scopes. Store credentials securely and restrict access to authorized engineers only.

Step 3 – Connect Payment API with App Backend

Create server endpoints for intents, tokens, and webhooks with idempotent logic. Log request and response IDs so support can trace failed or disputed charges quickly.

Step 4 – Test Transactions in Sandbox Mode

Run happy paths, failures, timeouts, and 3D Secure prompts on real devices. Test refunds, partial captures, and retries to catch race conditions before release.

Step 5 – Go Live with PCI-DSS & SSL Security Checks

Verify TLS, key rotation, and role-based access across engineering and support tools. Document fallback steps, on-call ownership, and maintenance windows for future updates.

Common challenges during integration

- SDK or OS version mismatches across devices

- Unhandled webhook retries are causing duplicate records

- Incomplete 3D Secure flows on weak networks

- Currency rounding issues during refunds or settlements

- Conflicts between promo logic and subscription renewals

- Missing logs that slow dispute resolution

Why experienced developers matter

- They design idempotent flows that prevent double charges

- They add clear observability for finance and product teams

- They plan safe rollbacks and test plans for real peak traffic

- They handle PCI controls without slowing feature delivery

What Affects Payment Gateway Integration Cost in UAE?

The payment gateway integration cost in UAE depends on the scope, security depth, and the features your model needs. Pricing also varies by gateway contracts, acquirer terms, and testing time across real devices and networks. Clear requirements, strong test plans, and clean documentation reduce rework and shorten your launch window.

Factors That Influence Cost:

1. Type of payment gateway (local vs global)

2. API complexity

3. Number of payment methods (card, wallet, BNPL)

4. Level of security (PCI controls, encryption)

5. Mobile platform (Android, iOS, or cross-platform)

Average Cost Range in UAE

| Integration Type | Estimated Cost (AED) | Suitable For |

|---|---|---|

| Basic Gateway (Single API) | 3,000 – 5,000 | Small apps |

| Advanced Setup (Multi-Payment) | 7,000 – 10,000 | Mid-size businesses |

| Custom Enterprise Integration | 10,000+ | Large enterprises |

Working with local specialists lowers risk because they understand acquirer rules and typical approval issues. Final cost changes with sandbox coverage, 3D Secure behavior, subscription flows, and the number of rounds needed in UAT.

How Custom Payment Integration Improves App Experience

Great checkout lifts conversions, reduces support tickets, and builds lasting trust with returning buyers. Custom payment integration for apps in UAE aligns your flow with currency preferences, language needs, and regional banking habits. It also supports one-tap flows, vouchers, and refunds without breaking accounting or subscription lifecycles.

Localized currency displays reduce confusion, and Arabic or English labels increase clarity during authentication steps. Smart retries and clear error states help buyers finish orders even on weak networks. Solid dashboards give finance and support quick access to settlement status, disputes, and refund history.

Benefits at a glance

- Faster purchase flow

- Reduced cart abandonment

- Higher confidence during checkout

Choosing the Right Development Partner for Payment Gateway Setup

You need a team that understands SDK quality, webhook design, and acquirer expectations in the region. Ask for examples covering Telr, Amazon Payment Services, Checkout.com, PayTabs, and Stripe in real mobile builds. Review how they handle tokens, retries, and logs, and how they support finance with clean reports.

Security skills matter because one weak control can cause chargebacks and lost approvals during peaks. Look for post-launch support, alerting, and clear rollback steps for future updates and bank changes. A strong partner will map a reliable payment gateway for mobile apps in UAE to your roadmap and growth plans.

Conclusion

Secure, simple payments raise approvals, cut churn, and protect revenue during peak periods across verticals. A well-planned gateway with clear logs, SDKs, and testing supports growth and fewer billing issues. Card, wallet, and BNPL support matches habits, while quick flows reduce friction and increase repeat orders. To add secure payment options to your mobile application, contact our mobile app development company in UAE with confidence.

Shiv Technolabs audits your checkout, recommends a gateway, and delivers a production-ready build on schedule. We align pricing, refund flows, and payout timing with your finance calendar, add monitoring, and run sandbox tests on devices.

FAQs About Payment Gateway Integration in UAE

Q1: Which payment gateway is best for UAE mobile apps?

Telr and Amazon Payment Services work well for local needs and strong risk controls. Checkout.com and Stripe suit cross-border or subscription models where multi-currency and billing logic matter.

Q2: How long does integration take for a UAE app?

Most apps go live in one to three weeks when requirements are clear. Complex subscriptions, marketplaces, or mixed methods may need more time for testing.

Q3: Can I accept both AED and USD payments in my mobile app?

Yes, many providers support multi-currency with settlement rules. Checkout.com and PayTabs are common picks for apps selling across markets.

Q4: What is the typical cost for integration in the UAE?

Budgets usually fall between AED 3,000 and 10,000+. Larger builds with custom flows exceed that range, depending on testing depth.

Q5: Is it safe to connect a payment gateway in a UAE app?

Yes, with SSL, PCI controls, and secure APIs, safety remains high. Add logging, tokenization, and 3D Secure to lower fraud and protect user confidence.