Table of Contents

Germany’s insurance market is shifting fast toward digital-first operations across policy, claims, billing, and service teams. Many carriers choose an insurance software development service in Germany to modernize workflows, controls, and partner integrations. Leaders also plan to build insurance software in Germany that scales reliably, reduces manual steps, and strengthens customer experience.

Rising claim volumes, complex products, and tight audits raise the bar on speed and quality. Legacy tools fragment data and slow responses during renewals, complaints, recoveries, and dispute handling. A unified core connects policy, claims, billing, and communications so teams act quickly with full context.

This article explains the features, budget factors, and delivery stages for a modern German platform. You will see how privacy controls, clean UX, and smart integrations cut risk while lifting performance. If you want a plan, our team can scope a pilot, deliver quick wins, and scale.

Why Should You Build Insurance Software in Germany?

Insurers in Germany work under BaFin supervision with strict duties for reporting, controls, and product governance. GDPR adds consent tracking, access rights, encryption standards, and audit-ready logs across every data flow. Custom insurance software in Germany handles these needs with built-in safeguards and repeatable workflows.

A digital insurance platform connects policy, claims, billing, payments, and messaging into one operational view. Automation reduces rework, improves accuracy, and gives staff the context needed for faster decisions. Customers get quick quotes, clear updates, and simple service steps that build trust and loyalty.

Leaders track sales trends, loss ratios, and channel results through live dashboards and targeted reports. Open APIs connect banks, payment providers, brokers, and data vendors for faster underwriting and collections. Teams adopt new processes with clean interfaces, role-based permissions, and guided steps for each task.

Operational teams cut backlogs by replacing email chains with tracked tasks, service-level timers, and shared queues. Supervisors gain real-time visibility to reassign work, approve exceptions, and protect service targets during spikes. Finance benefits from cleaner accrual data, quicker reconciliations, and accurate postings from claims and premium flows.

Customers value quick decisions, transparent timelines, and self-service actions that remove calls and uncertainty. Clear portals, automated reminders, and real-time notifications improve satisfaction and reduce churn across product lines. Brokers work faster with shared notes, document templates, and status views that shorten placement cycles.

Benefits of custom insurance software in Germany:

- Real-time claim tracking

- Automated policy renewals

- Integrated customer communication tools

- Regulatory-ready data storage

- Reliable billing and payment systems

Start with a focused pilot for one product or channel, then expand based on measured gains. This staged approach limits risk, speeds feedback, and builds momentum for broader transformation. When you are ready, our team can design a roadmap, estimate a budget, and confirm a timeline.

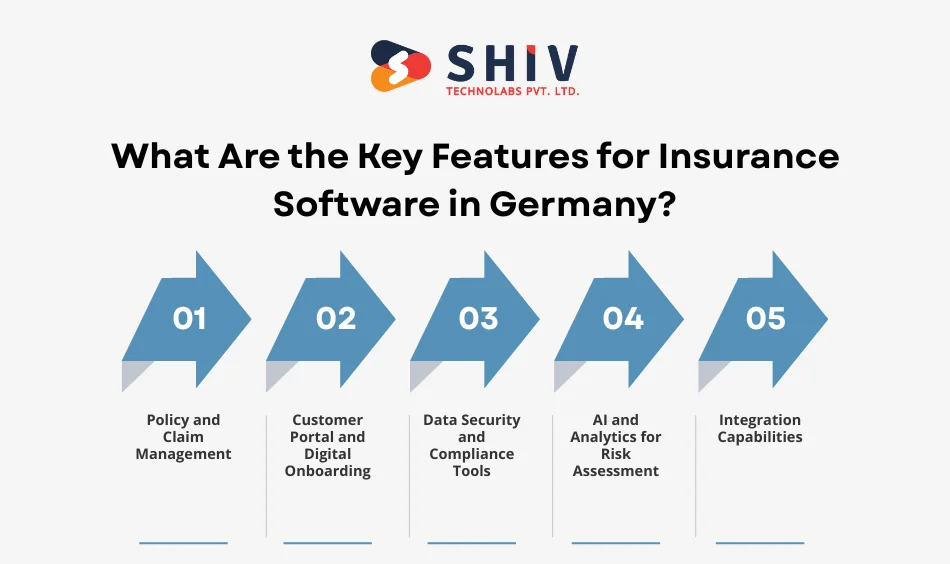

What Are the Key Features for Insurance Software in Germany?

German carriers need practical modules that cut errors, shorten cycles, and support strict oversight without extra friction. The key features for insurance software in Germany focus on speed, clean data, and consistent customer journeys across every channel.

Modern builds must help staff act quickly while keeping a clear audit trail across policy, claims, and billing. Our approach pairs proven workflows with flexible settings, so teams adapt fast and keep service promises during peak periods.

Policy and Claim Management

Automate policy creation, endorsements, renewals, and cancellations with role-based steps, due dates, and clear approvals. Link intake, investigations, reserves, and settlements so teams reduce leakage, resolve disputes faster, and improve payout accuracy. For product backlogs and iterative releases, align with custom software development best practices.

Customer Portal and Digital Onboarding

Offer instant quotes with guided questions, live eligibility checks, and transparent pricing before submission on any device. Add e-signature, KYC, and smart document capture so applicants finish in one session without repeated follow-ups.

Data Security and Compliance Tools

Protect records with encryption in transit and at rest, plus time-bound access and granular permissions. Track consent, subject access, retention schedules, and lawful bases aligned with GDPR, BaFin guidance, and Solvency II.

AI and Analytics for Risk Assessment

Support underwriting with risk scores, probability of loss, and pricing guidance built on historical patterns. Detect fraud with anomaly checks across devices, locations, networks, and claimant behavior at filing and payout.

Integration Capabilities

Expose and consume APIs for banks, payment providers, ID checks, address services, and credit bureaus. Connect government portals and tax systems to cut rekeying and speed reconciliations across underwriting, claims, and finance. Reference options and patterns on your custom API development service, and delivery patterns on web app development.

These modules replace scattered emails with tracked tasks, shared queues, and measurable service levels across teams. Managers see bottlenecks early, reassign work, and protect customer timelines when volumes spike after major events.

Feature Summary

| Feature Category | Description | Business Benefit |

|---|---|---|

| Policy Module | Automates lifecycle from quote to renewal | Faster processing |

| Claim System | Tracks intake, reserves, settlement | Fewer manual errors |

| Security Tools | GDPR and BaFin controls with audits | Strong data protection |

| Analytics | Forecasts risk and portfolio trends | Better decisions |

A focused feature set delivers fast wins, then scales across products, partners, and regions with minimal disruption. Start with one line of business, measure gains, and expand based on clear targets and user feedback.

How Much Does Insurance Software Development Cost in Germany?

Clients often ask, how much does insurance software development cost in Germany for a modern, audit-ready platform. The price depends on feature depth, integrations, data volume, and the target scale for launch. Regulatory scope also matters, since BaFin, GDPR, and Solvency II introduce controls that shape effort.

Most buyers pick one of three pricing models based on risk tolerance and scope clarity. A fixed-price model fits a tightly defined scope with signed requirements and limited change windows. Time-and-materials suits evolving needs, while a dedicated team model supports long roadmaps with steady throughput. If you need extra velocity, consider short-term capacity via IT staff augmentation.

Feature complexity drives the largest swings in budget and timeline across product lines. A claims-first build with straight-through rules, fraud checks, and payments needs extra design and validation. A policy-focused build with endorsements, renewals, and multi-channel quoting requires rules, templates, and careful testing.

Integration scope also affects cost, because external services add design, security checks, and joint testing. Typical partners include banks, payment gateways, ID checks, address services, credit bureaus, and government portals. Each upstream or downstream system adds mapping, error handling, and performance work during peak cycles.

Non-functional needs add effort that many teams overlook during initial planning sessions. Security reviews, logging, audit trails, performance tests, and availability targets require time and discipline. Training, cutover planning, and support playbooks also matter because they protect user adoption after go-live.

Estimated Cost for Insurance Software Development

| Project Type | Estimated Cost Range (€) | Delivery Time |

|---|---|---|

| Basic Insurance Portal | €25,000 – €40,000 | 2–3 months |

| Mid-level Platform with API Integration | €45,000 – €90,000 | 4–6 months |

| Enterprise Digital Insurance Platform | €100,000+ | 6–9 months |

These ranges reflect typical builds with standard modules, clear milestones, and realistic feedback cycles. Your figures may vary based on data migration, reports, custom rules, or partner testing windows. We validate numbers during discovery, then set a delivery plan that matches business targets.

Factors that affect Cost

- Software modules and complexity

- Integration with external systems

- Compliance and testing standards

- Team experience and hourly rates

- Maintenance and post-launch support

You can reduce risk and spend by phasing the scope across short, focused releases. Start with one product or channel, measure results, and extend features based on clear metrics. This approach protects timelines, limits rework, and gives leaders tangible progress to share with stakeholders.

We price builds with transparent assumptions and weekly progress checks across design, build, and testing. You receive early prototypes, demo-ready increments, and clear release notes for each milestone. If you want a tailored estimate, we can review goals, data sources, and timelines this week.

How Long Does It Take to Build Insurance Software in Germany?

Clients often ask, How long does it take to build insurance software in Germany for a compliant launch. Timelines depend on scope, integrations, data migration, and review cycles with internal teams and partners. A focused roadmap keeps momentum high and reduces rework across design, build, and testing.

A practical schedule for a first release usually falls between four and six months. Larger platforms take longer when they include complex rules, many integrations, and heavy reporting needs. You can shorten the path by phasing the scope and releasing value in smaller, measured increments.

Discovery and Requirement Analysis (2–3 Weeks)

We clarify goals, user roles, and reporting needs with short workshops and quick feedback loops. Analysts capture acceptance criteria and traceability so developers and testers work from the same playbook.

UI/UX Design (3–4 Weeks)

Designers create wireframes and clickable prototypes that reflect real tasks on desktop and mobile. Stakeholders review early, comment fast, and lock patterns so later changes stay light and predictable.

Development and Integration (10–16 Weeks)

Engineers build core modules for policy, claims, billing, and reports with clear milestones. They connect banks, identity checks, payment gateways, and government portals using monitored, versioned interfaces.

Testing and Quality Assurance (3–5 Weeks)

Testers run functional, performance, and security checks with traceable results and audit-ready logs. They verify consent, retention, and access rules so privacy teams remain confident during reviews.

Launch and Support (Ongoing)

The team manages cutover, training, and early fixes with defined service levels and clear ownership. Product owners plan small, steady releases that add features without risking platform stability.

Timeline Summary

| Phase | Duration | Key Activities |

|---|---|---|

| Analysis | 2–3 Weeks | Requirements, workflows |

| Design | 3–4 Weeks | Wireframes, prototypes |

| Development | 10–16 Weeks | Coding, integrations |

| Testing | 3–5 Weeks | QA, security, compliance |

| Launch | Ongoing | Cutover, support, updates |

How Insurance IT Solutions in Germany Support Digital Transformation

Modern insurance IT solutions in Germany mix automation, AI, and analytics to speed decisions and reduce leakage. Underwriters gain clear risk signals, adjusters close valid claims faster, and leaders see trends before problems grow. These gains arrive without adding friction for customers or partners across web and mobile.

Fraud checks review patterns in behavior, location, and device signals to flag unusual activity early. Dashboards track loss ratios, cycle times, and service targets so managers can act quickly during spikes. Clean integrations keep data consistent across policy, claims, and finance with fewer manual corrections.

Choosing the Right Partner to Build Insurance Software in Germany

Pick a team with proven delivery in German insurance and a strong track record with audits. Your partner should handle an insurance software development service in Germany from discovery to post-launch support. They must also be ready to build insurance software in Germany that scales from the first release.

What to look for:

- Experience with BaFin and GDPR controls across policy and claims

- Solid engineering depth, security skills, and real references

- Transparent pricing, weekly progress notes, and milestone demos

- Portfolio of enterprise builds with measurable results

FAQs Related to Building Insurance Software in Germany

What is the average cost to develop insurance software in Germany?

A simple portal usually lands around €25,000. Enterprise builds with rich features, and integrations start at €120,000+. Migration scope, compliance depth, and API count drive the final bill.

How long does it take to build insurance software in Germany?

Most full builds take four to six months from design through testing. Heavy integrations or extra audits can add weeks. We can phase the scope to hit earlier milestones.

Which features are most important for insurance software in Germany?

Start with policy management and claims automation. Add data security, a customer portal, and regulatory controls. Bring in reporting and payments once core flows run smoothly.

Are German insurance IT systems required to comply with GDPR and BaFin?

Yes. Platforms must meet GDPR, BaFin, and Solvency II. That includes consent, logging, retention, and audit-ready reports.

Can small insurance agencies also afford custom insurance software?

Yes. Go modular: launch essentials first, then add modules as results and budgets grow. This path keeps risk low and value visible.

Conclusion – Future of Insurance Software in Germany

German carriers are moving to modular platforms that cut manual work and speed fair outcomes. Clear audit trails, tighter fraud checks, and strong self-service raise trust with customers, brokers, and regulators. Role-based permissions and time-stamped logs support faster approvals and confident supervisory reviews.

Plan your next step with a phased roadmap, shipping small releases and measuring results at each milestone. Link once to your custom software development solutions page for details, budgets, and contact options. For a reliable build and sustained growth, partner with Shiv Technolabs for discovery, delivery, and support. Set clear targets for cycle time, straight-through rates, and adoption before scaling across products.